How AI is Revolutionising AR Oversight for Principal Firms

The Financial Conduct Authority (FCA) is intensifying its focus on how principal firms oversee their ARs. including ensuring financial promotions meet regulatory standards—a challenge where many firms struggle to maintain consistency.

A recent FCA review of 270 firms uncovered significant shortcomings in AR oversight.

But inadequate oversight doesn’t just pose risks to consumers; it also exposes principal firms to increased scrutiny and enforcement action. So, what's the solution in 2025?

Quick Summary of AR Oversight

- 1 out of 3 of principals do not leverage data to monitor AR activities, missing early warning signs of non-compliance.

- AI tools can help identify risks early and manage large AR networks efficiently, especially with financial promotions.

- Finspector AI offers principal firms fast risk detection, monitoring tools, and audit trails tailored to financial promotions compliance.

FCA Focus on AR Oversight

The FCA’s recent review of 270 firms revealed significant gaps in oversight processes, underscoring the challenges faced by principal firms. Key findings included:

- Data and Monitoring: A third of principals were not using data or management information to track whether ARs were acting within the scope of their agreements.

- Self-Assessments and Reviews: One in five principals had not carried out the required self-assessment or annual review of their ARs.

- Reviewing AR Agreements: Approximately half of principals were not regularly reviewing their AR agreements.

- Onboarding and Termination Procedures: Most firms had not updated their AR onboarding or termination procedures since the introduction of the new rules.

“Principals must have clear, written AR agreements from the outset and effectively monitor their ARs to make sure they act within scope.” - Jane Savidge, Interim Head of Department for ARs @ FCA

These findings illustrate the pressing need for principal firms to enhance their oversight mechanisms and embrace solutions that simplify compliance processes.

The consequences of poor oversight are significant. Firms risk fines, reputational damage, and increased regulatory scrutiny. For principal firms, ensuring robust compliance isn’t just a regulatory obligation—it’s a business imperative.

The Role of AI in Addressing Oversight Challenges

The complexities of AR oversight demand solutions that can scale efficiently while ensuring robust compliance. This is where AI becomes invaluable.

By automating repetitive tasks and identifying risks in real-time, AI-powered tools are transforming how principal firms manage compliance.

Here’s how AI bridges the gap between regulatory demands and operational efficiency:

- Scalability: AI enables firms to handle oversight for large networks of ARs without overwhelming internal resources. As networks grow, AI ensures that compliance processes remain consistent and manageable.

- Risk Identification: Through advanced algorithms, AI identifies potential compliance breaches before they escalate, allowing firms to act proactively.

- Workflow Optimisation: Integrating AI into compliance back-and-forth can significantly save time, especially when dealing with marketing teams such as with financial promotions.

By integrating AI into their oversight processes, principal firms can confidently meet regulatory expectations while focusing on growth and innovation.

Finspector Simplifies FinProm Compliance for Principal Firms

For principal firms, ensuring compliance in financial promotions is one of the most challenging aspects of AR oversight.

Misleading or non-compliant promotions can result in fines and reputational damage, which is why Finspector’s AI-driven capabilities are designed to help ensure ARs maintain compliance across digital platforms.

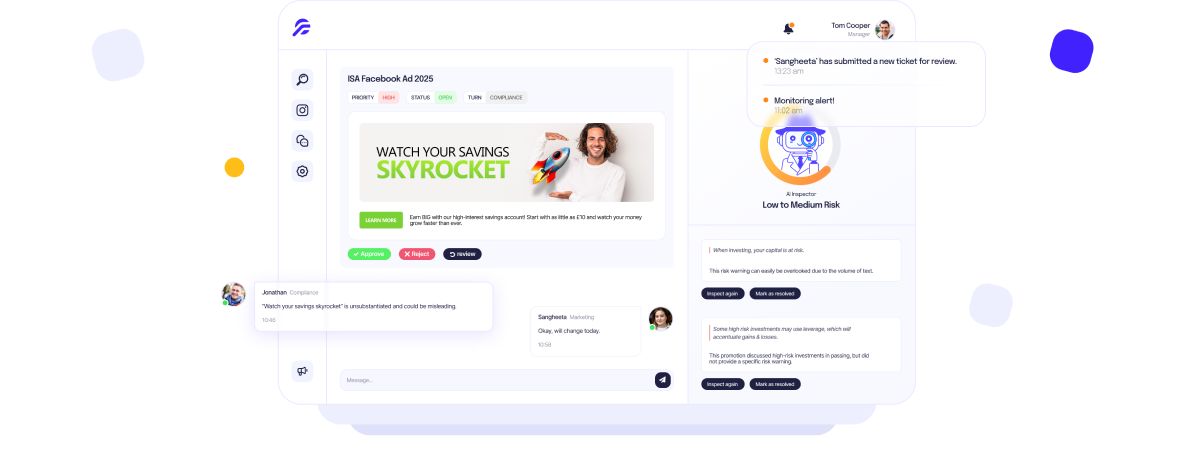

- Monitor Social Media Activity: Automatically track AR promotions across platforms like Twitter, Instagram, and TikTok to spot compliance risks.

- Identify Risks Instantly: : Finspector’s AI inspects content for risky phrases like “guaranteed returns” or incomplete risk disclaimers, alerting teams in real time.

- Streamline Approval Processes: Manage approvals for AR promotional materials from a single dashboard, complete with comments and notifications.

- Complete Audit Trails: Maintain a full record of promotional reviews and flagged issues to stay prepared for FCA audits or internal reviews.

By leveraging Finspector, principal firms can confidently oversee AR social media activities and ensure compliance with ease.

Use Cases for Different Types of Principal Firms

Mortgage Networks

Imagine you're a mortgage network managing 50 ARs, where keeping track of every social media profile and posts can quickly become overwhelming. Finspector’s monitoring tools can automatically identify compliance risks in social media content, ensuring ARs operate within regulated boundaries.

Compliance Services Firms

As a compliance services firm, delivering value to clients depends on efficiency and precision. Finspector accelerates the review process, cutting review times from hours to minutes. This frees up your team to focus on strategic oversight, developing robust compliance systems, and delivering exceptional client service.

Fintech Principal Firms

For fast-moving fintech firms, agility and innovation are key. With Finspector, you can stay ahead of rapid promotional cycles without compromising compliance. Its API-first approach and seamless integration with existing digital tools ensure compliance processes are embedded into your workflow, allowing your team to innovate confidently.

Stay Ahead with Finspector AI

With Finspector’s AI-powered oversight, you can simplify compliance, mitigate risks, and confidently manage AR promotions—no matter the scale.

Don’t wait for a compliance mishap to impact your firm. Discover how Finspector can transform AR oversight—schedule your free demo today!