Demystifying AI for Curious Compliance Managers

If you're a compliance manager, you’re already seeing how AI is reshaping the industry—saving time, reducing risks, and enhancing compliance workflows.

And while you don’t need to be an expert in the technology to benefit from solutions like Finspector AI for Financial Promotions Compliance, a little insight into how it works can go a long way.

This blog will break down how Large Language Models (LLMs), like the ones behind ChatGPT, operate and how Finspector builds on this advanced tech to support compliance managers.

The Basics: How do LLMs work?

If you’re familiar with tools like ChatGPT, you’ve already seen how LLMs can interpret and generate language with remarkable accuracy.

These models, trained on vast and diverse datasets, process text by breaking down sentences into smaller parts, using statistical patterns to predict and understand context. Importantly, LLMs learn from a broad mix of sources—books, websites, articles, and, yes, even financial language and promotional material.

However, the process isn’t like traditional “reading.” Instead, LLMs form language patterns from seeing text in context across millions of examples, letting them recognize familiar structures or phrases without understanding “meaning” the way humans do.

That means we can never really "know" what an LLM is thinking. But we do know that its responses are based on patterns and probabilities, making it incredibly useful for identifying language risks!

If you haven't tried it yet, we suggest you run some financial promotions through ChatGPT or Gemini and ask it to identify potential compliance risks. See how it does and then come back to this post..

Should I Just Use ChatGPT then?

So now you've tried putting a few financial promotions through a general-purpose LLM, you’ve likely seen some real potential. The ability to quickly scan for risks and save time can be invaluable. But you may have also noticed some limitations, such as:

- Random, Irrelevant Risks: Sometimes, the LLM flags things that aren’t truly risky, leading to more work on your end.

- Limited Memory: It might feel like you have to start from scratch every time, as the tool doesn’t retain previous feedback or adjustments.

- Accuracy Challenges: Without customisation, general LLMs may miss crucial nuances in financial language.

- Workflow Disruptions: Going back and forth between the LLM and your regular workflow can quickly become cumbersome.

- Length Limitations: LLMs can only handle a few pages of text at once, so with long documents, you’d need to chop them into smaller sections. This can break up critical context and make reviews less efficient.

- Can't Do Video/Audio: LLMs like ChatGPT often can’t analyze audio or video content. So, if your financial promotions include video ads or podcasts then you'll struggle.

Sound familiar?

That’s because general-purpose LLMs, like ChatGPT, weren’t specifically designed for FinProm compliance. Finspector on the other hand...

6 Ways that Finspector Elevates Compliance AI

Finspector offers a solution that goes beyond general LLM capabilities. Our AI model integrates seamlessly into your workflow, uses a tailored feedback mechanism to adapt to your compliance needs over time, and reduces unnecessary flags—all to provide reliable, accurate insights that grow alongside your team’s expertise.

- Plug in Your Custom Checklists

With Finspector AI, you can integrate your own custom checklists or start with our helpful starters to create a tailored suite of automatic compliance checks. - Feedback Loops to Match Risk Appetite

Using a feedback mechanism, compliance managers can flag areas for improvement or add unique compliance needs. Over time, the AI incorporates this feedback, which means it starts “learning” to flag content according to your company’s risk tolerance. - Increased AI Accuracy

Compliance AI needs to be accurate—not just in spotting risks but also in minimising false alarms. By refining our models through client feedback, Finspector has shown measurable improvements, decreasing unnecessary flags and increasing risk detection. - Best Model in Class

We continuously compare various LLMs to determine which performs best for risk detection. This ongoing evaluation process means Finspector is equipped with the latest and most relevant AI solutions, tailored for financial promotions compliance. - Handles Longer Documents: Finspector is built to process lengthy documents without needing them split into smaller sections. So longer financial promotions can be reviewed in one go, preserving context and efficiency.

- Supports Multimedia: Finspector is equipped to review formats like video ads, podcasts, and webinar content. It can audio and video, automatically pre-processing these formats into text, so you won’t need to convert them manually.

How Finspector Fits into Your Workflow

While tools like ChatGPT or Gemini are helpful, Finspector takes AI integration a step further to streamline compliance tasks:

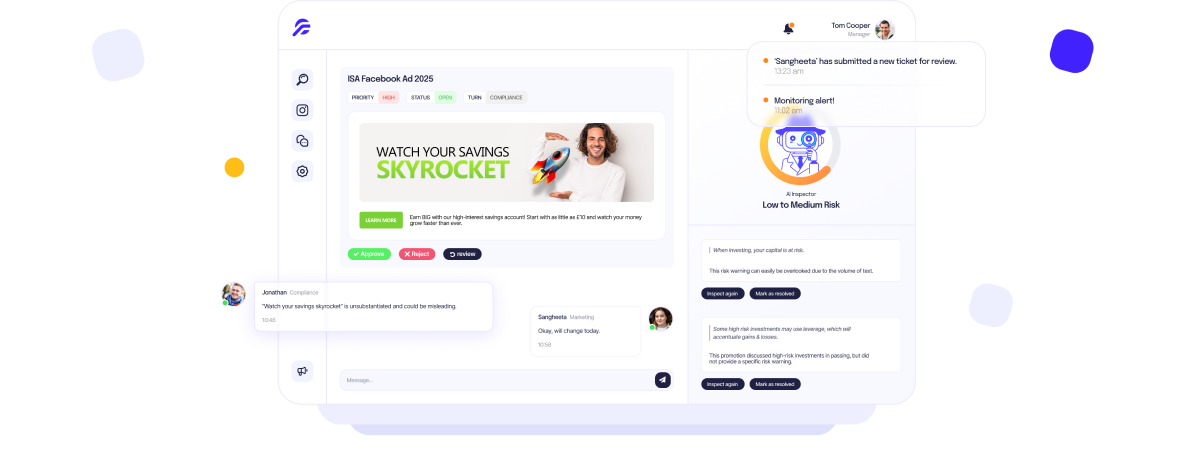

- Financial Promotions Dashboard: All-in-one dashboard for financial promotions with comments, suggestions, notifications for marketing and compliance teams.

- Seamless AI Integration: AI will highlight compliance risks whenever compliance teams receive a financial promotion to review.

- Automatic Auditing: All interactions with the tool are logged, ensuring compliance progress is documented and easy to audit when necessary.

- Monitors Social Media: Twitter, Tiktok and Instagram profiles can be monitored for potential compliance risks continuously, giving you peace of mind.

Looking Ahead: From GPT to Finspector

Understanding how LLMs work is just the beginning. As Finspector builds on this technology, it provides a compliance-focused approach that keeps up with evolving regulations while fitting into the day-to-day workflows of financial promotions teams.

By making compliance easier to manage, Finspector enables your team to focus on what they do best—delivering effective, engaging, and compliant financial promotions.