Faster Compliance, Better Financial Products for Everyone

Regulatory compliance, particularly in financial promotions, is a significant bottleneck that slows down the launch of new offerings.

While compliance frameworks are necessary to protect consumers and maintain market integrity, they can also create unintended consequences—making it especially challenging for SMEs to compete effectively.

AI is emerging as a game-changer, offering solutions that expedite marketing while ensuring compliance. This means consumers don’t have to wait months or years to access better banking, lending, insurance, and investment products tailored to their needs.

Quick Summary: How AI Unlocks Compliance Efficiency for SMEs and Consumers

- Regulatory red tape slows SME innovation, delaying new financial products that could benefit consumers.

- 75% of compliance teams face rising regulatory pressure, making approvals slow and costly.

- AI cuts through the bottleneck, automating checks, monitoring promotions, and prioritizing risks for faster approvals.

- Consumers win too, with quicker access to innovative, transparent, and trustworthy financial products.

The Compliance Bottleneck and Impact on SMEs

Financial promotions must meet strict regulatory requirements to ensure they are clear, fair, and not misleading. These regulations, such as those enforced by the FCA, are designed to prevent consumer harm but often come at the cost of agility and efficiency.

For SMEs, the impact is particularly severe:

- Resource Constraints: Unlike larger financial institutions with dedicated compliance teams, SMEs often lack the resources to navigate complex regulatory requirements efficiently.

- Time Delays: The manual review and approval process for financial promotions can take weeks or even months, delaying product launches and market entry.

- Competitive Disadvantage: Larger firms can afford to invest in faster compliance solutions, giving them an edge over SMEs struggling with regulatory hurdles.

75% of compliance decision makers in financial services agree that regulatory demands on their compliance team have significantly increased over the past year.

How AI Can Expedite Financial Promotions Compliance

AI-powered compliance solutions offer a promising way to break this bottleneck. By automating and optimising key elements of the compliance process, AI can enable SMEs to launch new financial products more quickly and efficiently. Here’s how:

1. Automated Content Analysis

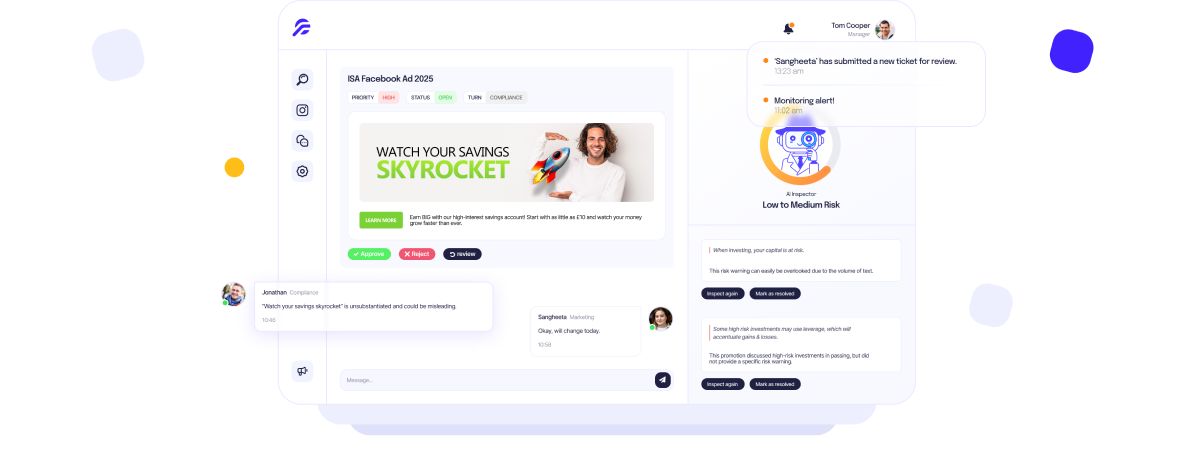

AI-driven compliance tools can scan financial promotions in real time, checking for regulatory adherence. These can detect misleading claims, unauthorised phrases, and potential compliance risks within seconds. This reduces the need for manual review and accelerates approvals.

2. Real-Time Compliance Monitoring

Rather than reviewing promotions only at the submission stage, AI can continuously monitor financial promotions across multiple channels, including social media. This ensures ongoing compliance even after a campaign has launched, reducing the risk of regulatory breaches.

This is especially useful for firms working with influencers or those with appointed represantatives.

3. Risk-Based Review Prioritisation

AI tools can inspect financial promotions based on users' risk level, allowing compliance teams to focus on high-risk cases while approving lower-risk promotions faster. This prioritisation ensures that compliance resources are used efficiently.

Consumers can benefit from more trustworthy financial products that are thoroughly vetted for fairness and transparency before they even hit the market.

4. Enhanced Accuracy and Consistency

Manual compliance reviews can be subjective and prone to human error. Especially for compliance managers dealing with tedious manual checks that reoccur daily. AI, on the other hand, applies standardised rules across all promotions, ensuring greater consistency and accuracy in compliance enforcement.

The Future of AI-Driven Compliance in Financial Promotions

Regulatory bodies are recognising the role of technology in streamlining compliance processes. The FCA, for instance, has been exploring the use of AI to enhance financial regulation as seen in their AI Spotlight Showcase.

"..AI has the potential to transform financial services. It offers benefits ranging from enhanced customer experiences and better consumer outcomes.." - Jessica Rusu, FCA

As AI adoption grows, SMEs that leverage AI-driven compliance tools will be better positioned to compete with larger players and bring innovative financial products to market. The key lies in embracing AI as an enabler—one that not only ensures adherence to regulations but also unlocks new opportunities for growth and customer engagement.

For consumers, this translates into a steady stream of modern, competitive, and transparent financial solutions that better serve their needs.

AI Compliance Use Cases for SMEs

Fintech Startups

For fintech startups, speed and agility are everything. But regulatory hurdles can slow down product launches, preventing innovative financial solutions from reaching consumers. AI-driven compliance tools like Finspector ensure fintech firms can quickly approve marketing campaigns and keep up with fast-moving promotional cycles—without compromising compliance.

Insurance Brokers

For independent insurance brokers keeping track of promotional materials across multiple platforms can be overwhelming. Automated alerts highlight potential risks before they become regulatory issues, allowing brokers to focus on growing their business confidently.

Investment Platforms

SMEs running investment platforms need to communicate complex financial information clearly and accurately. AI-powered compliance checks help identify misleading claims and ensure risk disclosures are present in every promotion. This safeguards investors while enabling platforms to scale their marketing efforts efficiently.

How Finspector Accelerates Your Compliance

Finspector is at the forefront of AI-driven compliance solutions, designed to help SMEs streamline financial promotions. By leveraging cutting-edge AI technology, Finspector enables businesses to:

- Automatically scan and flag compliance risks in financial promotions, reducing the need for manual intervention.

- Provide real-time monitoring to ensure promotions and social media profiles are compliant proactively.

- Automatically log activity that helps SMEs maintain transparency and FCA alignment.

With Finspector, you can confidently launch new financial products while minimising regulatory delays. By integrating AI-powered solutions like Finspector into compliance strategy, SMEs can break the bottleneck, allowing them to compete with larger players and bring much-needed innovation to the market.

Interested in seeing how AI can help streamline your financial promotions? Stay ahead of the curve by exploring AI-driven compliance solutions with Finspector today!