7 Common Fears and Myths About Compliance AI

AI in financial compliance has become an exciting new frontier, promising to reduce risks, save time, and streamline the compliance workflow. But as with any new technology, adopting AI can raise concerns, especially for those new to it.

Compliance managers exploring AI often encounter myths and fears about complexity, job security, and the reliability of AI compliance tools.

In this post, we’ll tackle the 7 most common fears about AI, helping you understand how tailored solutions like Finspector can support, rather than disrupt, your compliance work.

1. It’s Too Complicated!

One of the most common fears about adopting AI in compliance is that it will be too complex to operate.

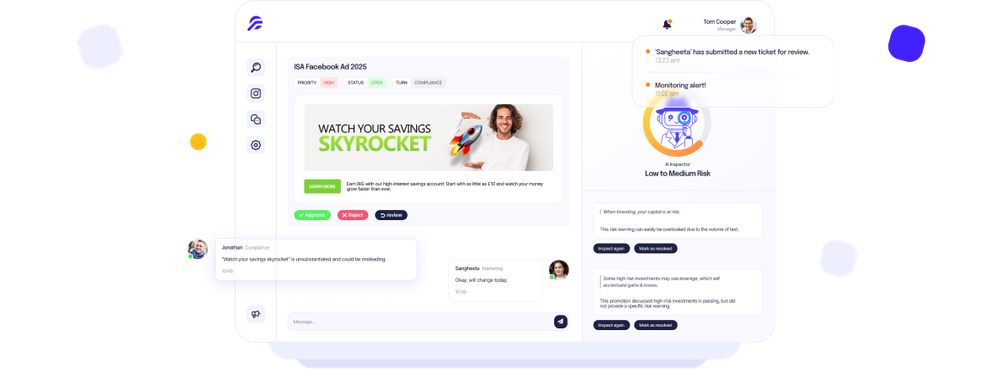

Reality: Modern AI compliance tools are designed with usability in mind. For example, Finspector offers an intuitive interface that allows compliance managers to work efficiently without needing deep technical expertise. These tools are built to simplify, not complicate, workflows by using a user-friendly interface that makes adopting AI for financial compliance straightforward.

2. It’ll Replace Compliance Jobs!

Another prevalent myth is that AI will eventually replace the role of compliance managers, eliminating the need for human oversight in compliance tasks.

Reality: AI in financial compliance is intended to assist compliance managers, not replace them. That means enhancing your decision-making by quickly identifying potential risks and highlighting areas of concern.

With Finspector, AI serves as an extra set of eyes, working alongside compliance teams to reduce time spent on manual reviews, allowing managers to focus on strategy and high-level decision-making.

3. It’ll Flag Everything and Waste Time!

AI solutions can sometimes produce “false positives,” identifying issues that aren’t actual risks. For compliance managers, this can lead to extra work rather than increased efficiency.

Reality: General-purpose AI may indeed over-flag, but specialised tools are calibrated specifically for financial promotions compliance. Finspector’s AI incorporates client feedback, minimizing unnecessary alerts and ensuring flagged content aligns with your risk appetite.

4. It’ll Disrupt My Whole Workflow!

For many professionals, the thought of integrating new technology brings up concerns about workflow disruptions. Compliance managers worry that AI compliance tools might create more steps, making daily tasks more complex.

Reality: Purpose-built AI compliance software, like Finspector, seamlessly integrates with your current workflow, also offering email notifications and API. Instead of adding steps, Finspector removes the inefficiencies of manual review, creating a streamlined, efficient workflow that enhances, rather than disrupts, compliance tasks.

5. It Can’t Handle Long Docs or Videos!

Some compliance managers assume that AI tools are limited to processing only short text documents and struggle with multimedia formats like video and audio, which are increasingly common in financial promotions.

Reality: While general-purpose AI can struggle with document length and multimedia content, Finspector is equipped to handle these formats. Its AI can analyse lengthy promotions in one go, including video and audio!

Not So Scary After All!

Adopting AI in compliance may seem intimidating, but with the right tools and understanding, it doesn’t have to be!

Modern AI compliance tools like Finspector are designed to address the unique needs of compliance managers, offering reliable risk detection, minimizing workflow disruptions, and supporting teams in their daily tasks.

- Seamless AI Integration: AI will highlight compliance risks whenever compliance teams receive a financial promotion to review.

- All-in-One Dashboard: With comments, suggestions, notifications for marketing and compliance teams.

- Automatic Auditing: Promotions and activity are logged, ensuring compliance progress is documented and easy to audit when necessary.

- Monitors Social Media: Twitter, Tiktok and Instagram profiles can be monitored for potential compliance risks continuously, giving you peace of mind.

Ready to see how Finspector can transform your financial promotions compliance?