2024 FCA Financial Promotion Breakdown: What the Data Means for You

FCA is upping the ante and there's no getting round it.

The latest report shows 19,766 financial promotions flagged in 2024—a 97.5% increase from 2023.

Whether you operate in insurance, consumer credit, investments or claims, this trend is a clear warning: promotions are being flagged at record levels.

But that’s only one side of the story. Which firms are at most risk? Why are promotions getting flagged? And most importantly:

What can you do about it?

In this post we explore:

- What’s the FCA changed?

- Which industries are at most risk?

- Five ways to protect your company

- AI and future of financial promotions

What is FCA FinProm Data 2024 Telling Us?

The FCA’s 2024 Financial Promotions Data paints a stark picture of a financial marketing landscape under increasing regulatory pressure. This year’s data isn’t just about rising numbers—it highlights a major shift in how financial promotions are being monitored, flagged, and penalised.

- With 19,766 promotions amended or withdrawn, this 97.5% increase from 2023 shows that the FCA is no longer just reactive—it’s a systematic crackdown on misleading advertising.

- Claims companies were hit hardest likely because aggressive marketing tactics continue to exploit consumer uncertainty.

- Consumer credit and lending firms are a growing focus, with a special mention for misleading interest rates and repayment terms.

- 20 finfluencers were interviewed under caution using FCA criminal powers, marking a significant expansion of oversight into social media and digital marketing channels.

"Over the past year, we have seen a growing number of misleading and illegal financial promotions. We have stepped up our efforts in response to make sure that financial promotions are clear, fair, and accurate."

- Lucy Castledine, FCA Director of Consumer Investments

What FCA FinProm Data Means for You

The FCA isn’t just reacting to misleading promotions—it’s proactively monitoring and pulling them before they reach consumers.

And considering the monitoring technology now available, we are a long way from how regulation was enforced a few years ago.

On the bright side, consumers are going to benefit from healthier promotions on billboards and smartphones. But it does mean you need to be prepared for this increased scrutiny.

If your firm isn’t prepared, you could face:

⚠ Marketing delays caused by intervention

⚠ FCA fines if your promotions do not protect consumers

⚠ Reputational damage if the FCA issues public warnings against your firm

5 Key Steps to Protect Your Firm from FCA Scrutiny

The worst compliance strategy is waiting for the regulators to flag your promotions. Instead, take proactive measures right now to avoid intervention.

1. Inspect Promotions

Ensure that every financial promotion is fact-checked for accuracy, includes clear risk disclosures, and does not exaggerate claims. The FCA has penalised firms for misleading consumers, with recent fines highlighting the high cost of non-compliance.

Implement a pre-launch inspection process to catch red flags before your promotions go live.

2. Regular Audits

Conduct quarterly reviews of your marketing materials, document compliance decisions, and track historical patterns of FCA interventions to avoid repeat mistakes.

3. Train Marketing Teams

Marketing teams often prioritise engagement, while compliance teams focus on risk mitigation—and misalignment leads to regulatory breaches.

Ensure that both teams are trained on FCA guidelines, particularly around financial promotions. This will not only protect your firm but save you precious time in back and forth.

4. Monitor Social Media

Finfluencers and affiliates are a great marketing tool, however they can be a headache to manage from a compliance perspective. You need to make sure you do both retroactive due diligence and proactive social media monitoring to make sure they don’t lead to problematic breaches.

Specifically, principal firms that are fully responsible for the compliance of appointed representatives are often at risk. Remember to closely monitor digital marketing activities as ARs will post on social media, not recognising they have unintentionally created a financial promotion.

5. FinProm Compliance Tools

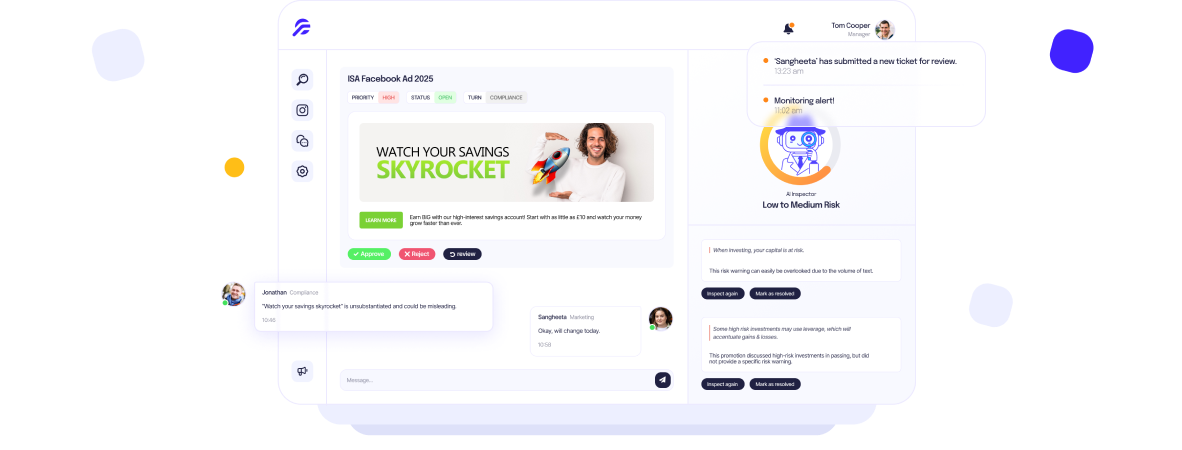

FinProm compliance tools like Finspector can automatically inspect promotions for compliance risks and monitor social media accounts. Automating compliance reduces human error and prevents costly FCA interventions.

Future of Financial Promotions: AI-Powered Compliance

Considering the increased FCA scrutiny, the future might look rough for compliance teams. Well, at least we think it will be for companies that have not adopted AI.

The traditional, manual approach to compliance is no longer scalable.

So, instead of relying on manual reviews, AI can automatically scan promotions to ensure risks are flagged before approval. Not only does this save time, but also reduces the risk of human error - especially with compliance often becoming a somewhat repetitive task.

With regulators now actively monitoring social media, AI provides real-time oversight on influencers and digital campaigns, preventing non-compliant content from going live. In a world where one flagged promotion can mean fines and real reputational damage, this is a proactive way to safeguard financial promotions—before the FCA steps in.

Ultimately, AI is not going to replace compliance managers though. There will always be a need for human oversight, expertise and nuance. But it should allow for a more healthy promotional world to blossom for consumers, whilst maintaining speed and efficiency for companies.

How Finspector AI Helps You Stay Ahead

Finspector is an AI-driven FinProm solution for simplifying compliance. To protect your company and align with FCA regulations, our platform helps you with:

✅ AI Risk Detection – Automatically flags compliance risks in financial promotions before they go live.

✅ Seamless Approvals –Allows marketing and compliance teams to collaborate in real time for faster approvals.

✅ Social Media Monitoring – Automatically inspect affiliate posts and influencer campaigns to prevent regulatory breaches.

✅ Detailed Audit Trails – Organised compliance records providing transparency and ease for FCA audits.

With a 97.5% increase in FCA interventions, you must take a proactive approach to financial promotions compliance.

Because in the end this isn’t just about avoiding penalties—it’s about building consumer trust and protecting your brand. With the FCA upping the ante, now is the time to get ahead of compliance risks.

Talk with us today. No obligations.