Top 5 FinProm Tips to Avoid FCA Fines

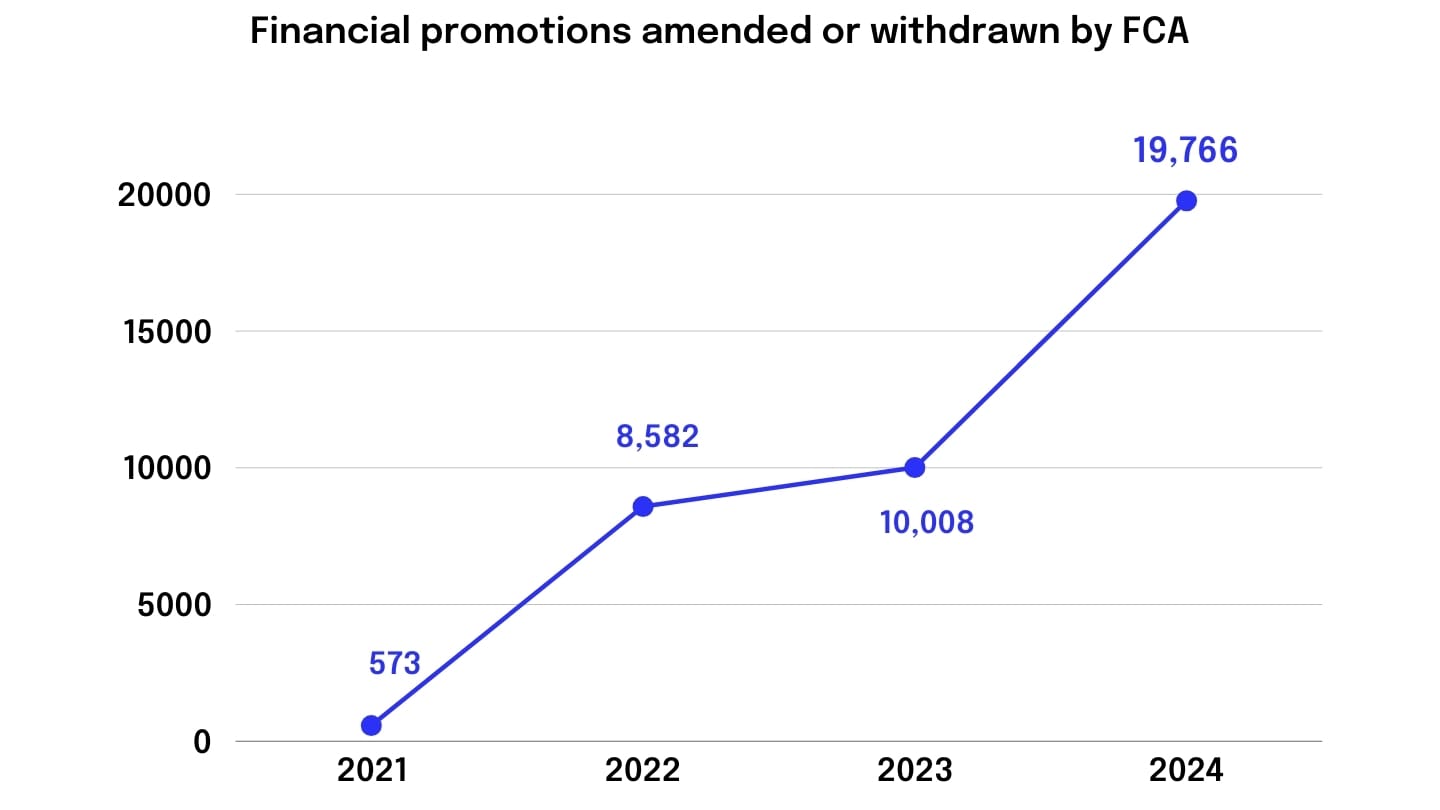

In 2024 the FCA intervened in 19,766 financial promotions. That's an astounding 34x increase since 2021.

And that's been accompanied by firms facing substantial fines for non-compliance, leading to reputational damage and financial losses.

How do you make you're on the right side of compliance?

🔍 FCA Crackdown: Are You Compliant?

This heightened scrutiny underscores the importance of your financial promotions being clear, fair, and not misleading. It's a simple mantra, but a powerful one.

Problem is, what does the FCA want exactly?

Read on to find out how you can avoid fines, stay compliant and review at speed!

1️. Keep It Real

❌ Avoid:

Using phrases like “guaranteed returns,” “best-in-market,” or “low-risk investment” without solid proof.

✅ Do:

- Back up every claim with verifiable data.

- Use qualifying statements (e.g., “Based on independent analysis, accurate as of 6th Feb 2025”).

- Obtain compliance sign-off before publishing any promotion.

2️. Be Transparent – Make Risk Warnings Clear

❌ Avoid:

Tiny disclaimers, hidden footnotes, or confusing language that makes risks hard to spot.

✅ Do:

- Equal prominence rule – Risks must be as obvious as benefits.

- Use plain English (no jargon, no legalese).

- On digital ads? No clicking required to see risk warnings.

3. Don't Forget Social Media

❌ Avoid:

Running paid social campaigns, influencer promotions, or viral finance memes without clear risk disclaimers or proper audience targeting.

✅ Do:

- Influencers must include disclaimers (#ad, financial promotion rules, risk warnings).

- Ensure social ads are targeted correctly – No high-risk promotions to retail investors.

- Run every post through compliance before publishing.

4️. Know Your Audience

❌ Avoid:

Marketing high-risk investments to unsophisticated investors without clear risk warnings or suitability checks.

✅ Do:

- Segment your audience – High-risk products should only be marketed to sophisticated investors.

- Ensure all high-risk investments have clear, prominent disclaimers about potential losses.

- Implement a strict compliance review before promoting investment opportunities.

5️. Build a Workflow with FinProm Tools

❌ Avoid:

Relying on manual compliance checks or last-minute approvals, which can delay campaigns and increase regulatory risks.

✅ Do:

- Establish a clear workflow where compliance is integrated from the start of content creation.

- Use AI-powered tools like Finspector to identify risks in real-time, reduce compliance workload, and ensure regulatory accuracy.

- Leverage dedicated solutions that provide audit trails, automated flagging, and AI-powered risk analysis.

"..AI has the potential to transform financial services. It offers benefits ranging from enhanced customer experiences and better consumer outcomes.." - Jessica Rusu, FCA

Stay Ahead of FCA Crackdowns!

FinProm compliance isn’t just about avoiding fines—it’s about building trust and credibility.

The problem we've identified is that traditional manual reviews can be time-consuming and prone to human error. By integrating Finspector, your firm can streamline approvals, reduce risks and launch FCA-compliant promotions at speed!

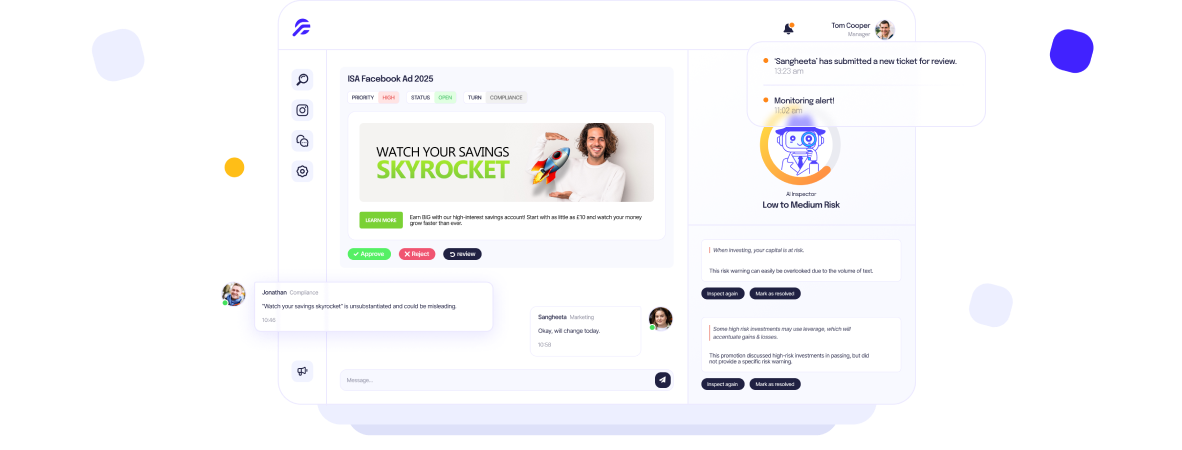

✅ AI Risk Detection – Automatically flags compliance risks in financial promotions before they go live.

✅ Seamless Team Workflow – A centralised dashboard allows teams to collaborate in real time for faster approvals.

✅ Continuous Monitoring – Automatically inspects social media posts and influencer campaigns to prevent regulatory breaches.

✅ Detailed Audit Trails – Organised compliance records providing transparency and ease for FCA audits.

By leveraging Finspector, your firm can navigate the complexities of financial promotions with confidence, ensuring that your campaigns are not only compelling but also compliant with FCA regulations.

Discover how Finspector can transform compliance —schedule your free demo today!