The Danger of Sales: Unintentional Financial Promotions

A well-meaning (and slightly wild) business development rep shares a post on LinkedIn;

Exciting news! 🎉 Our new investment fund has already seen incredible returns for early investors, and we’re just getting started. Don’t miss out on this amazing opportunity to grow your portfolio! 🚀

No harm intended—but this is a textbook example of an unintentional financial promotion.

Unintentional financial promotions are a growing challenge for compliance teams, particularly in industries where business development professionals are highly active on platforms like LinkedIn and Twitter.

These teams often operate at the forefront of client engagement, but their sales-driven language can unintentionally cross regulatory boundaries.

The Risk of Sales

For business development teams, even casual LinkedIn posts or tweets can inadvertently fall into financial promotion.

The risks arise when promotional language is used without ensuring compliance with financial regulations, such as including risk disclaimers or adhering to FCA guidelines in the UK.

Why Sales Teams Are Especially at Risk

- Sales-Oriented Language: Business development professionals are trained to highlight benefits, which can often be perceived as financial advice or inducement.

- Lack of Awareness: Many team members are unaware of how social media content can qualify as financial promotions.

- High Volume of Activity: Platforms like LinkedIn and Twitter are integral to networking and prospecting, increasing exposure to potential regulatory breaches.

And any potential breaches can easily lead to regulatory fines and real reputational damage.

Twitter and LinkedIn

LinkedIn and Twitter are the primary platforms for business development professionals, making them focal points for potential compliance risks:

- LinkedIn: Posts often include investment updates, client success stories, or promotional content. Without proper disclaimers or phrasing, these can easily qualify as financial promotions.

- Twitter: The platform’s brevity encourages simplified messaging, which can omit critical compliance details. A single tweet can spread quickly, amplifying non-compliant messaging.

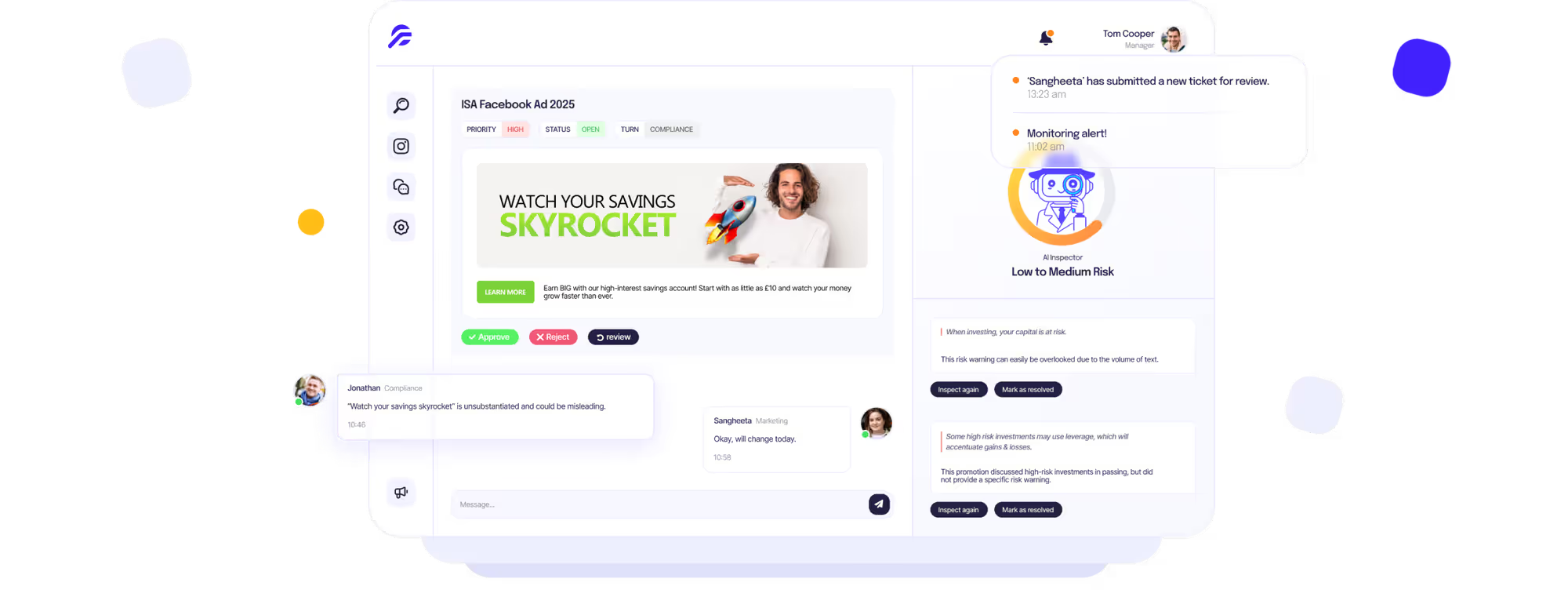

Finspector AI : Automatic Monitoring

You can now use AI technology to assist you in the automatic monitoring of social media posts. Finspector, our financial promotions solution, includes comprehensive monitoring of Twitter, Instagram and TikTok posts:

- Detecting high-risk phrases or speculative language.

- Highlighting missing disclaimers or unbalanced views.

- Providing audit trails for compliance reviews.

That means you can reduce stress and risk associated with your business development teams social media.

Build a Compliance-First Culture!

1. Educate

Do regular training sessions to make teams aware of financial promotion regulations, whilst sharing practical examples of compliant versus non-compliant content.

2. Integrate AI

Use Finspector as a safety net to empower teams to post confidently and reduce the burden on compliance teams by automating social media checks.

3. Build Trust

Emphasise to your sales teams that compliance is not a hindrance but a way to build trust and credibility with clients.

From Risk to Reward

Unintentional financial promotions are a real and pressing concern for firms, especially as business development professionals increase their presence on social media. Monitoring these activities is not about stifling creativity or sales efforts—it’s about protecting the firm’s reputation and developing trust with clients.

With tools like Finspector, firms can navigate these challenges with confidence, ensuring their teams remain compliant while engaging meaningfully with clients and prospects.

Get in touch, and we'll show you how Finspector can help monitor your social media presence today!