Finspector: Your Financial Promotions Review, Simplified.

As a compliance or marketing manager, we know the struggle to keep up with surging financial promotion compliance -and market competition- is real. We get it.

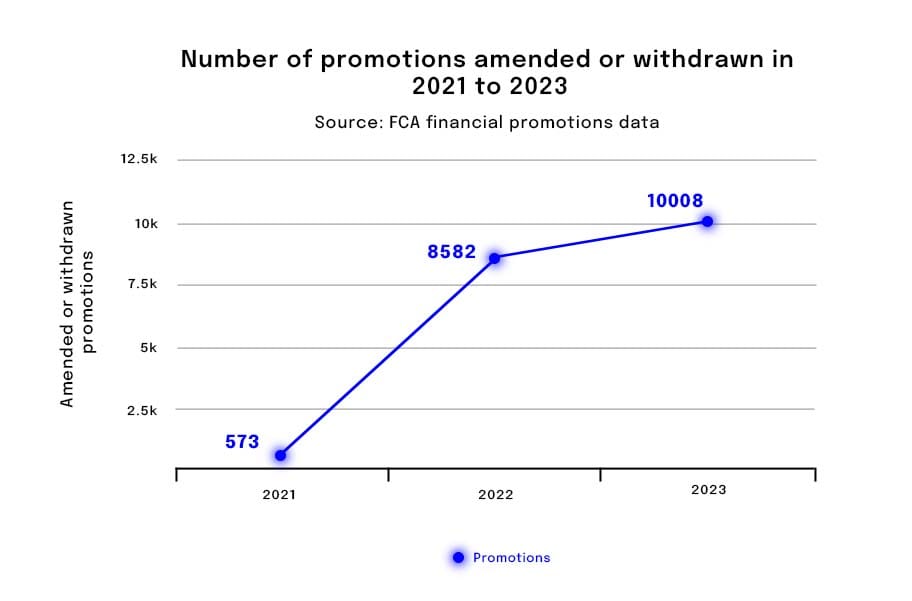

With the FCA placing a greater emphasis (and power of enforcement) on consumer protection, there's been a lot more attention and a lot more interventions for firms seen to be promoting misleading content. In 2023 alone, the FCA intervened on over 10,008 promotions. While this is great for consumer protection, it's also meant an overwhelming pressure on compliance teams to deliver huge volumes reviews and at speed, which has often counter-productively, led to slower approval times and even a higher risk of non-compliance.

But what if you could automate a big part of your review process?

With Finspector you can automatically inspect content for compliance risks, saving your team 1000's of hours in review time. This would mean faster approvals, reduced risk, and more resources free'd up for strategic tasks.

Here's some of the benefits you can enjoy with Finspector, your AI-powered FinProm compliance tool:

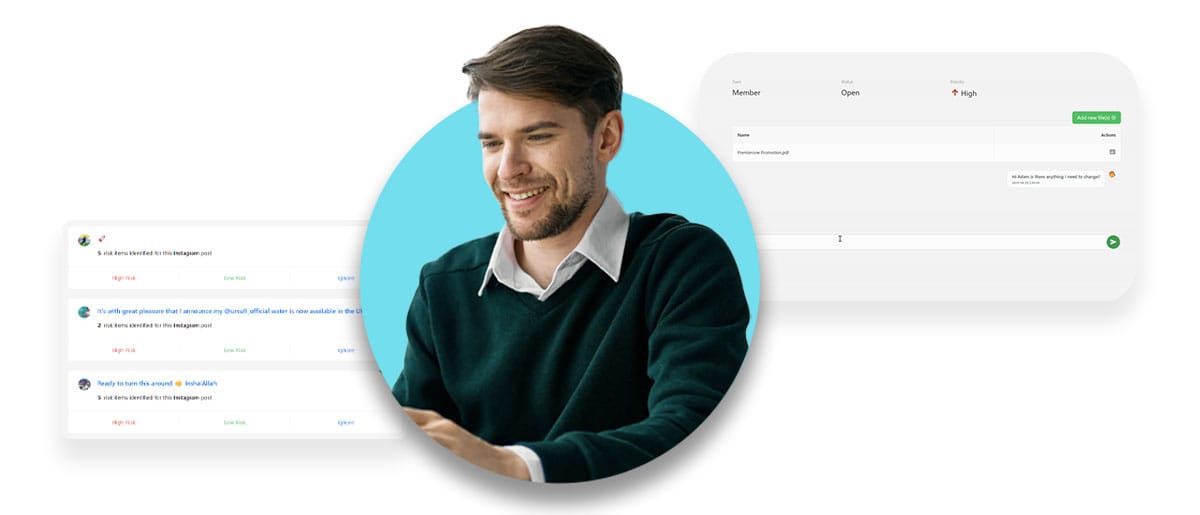

- Dramatically reduce your time spent reviewing financial promotions: With AI reviews for text, video, and audio for compliance risks, you could be saving 1000's of hours reviewing content. You can also create custom rules aligned with your compliance standards, and train the AI with easy-to-use testing and feedback to make the checks and reviews work for you.

- Minimise human error: Ensure more accurate and reliable compliance checks. You can now check through post histories and monitor social media profiles on Twitter, Instagram and TikTok in minutes. A welcome relief especially if you're worried about mis-selling, greenwashing, or inadvertently giving financial advice.

- Seamless integration into your existing workflows: Bring your marketing and compliance teams into a single, collaborative dashboard for comments, notifications, assignment tracking, prioritisation and the ability to loop in managers to sign off on content before they go live.

- Approve your content faster: Help your marketing team stay ahead of market trends and competitors with increased first time approvals and faster turnarounds.

- Easy Audits: Keep a comprehensive record of your compliance activities with detailed feedback and activity logs, ensuring a transparent and traceable compliance journey.

- Secure AI: Establish custom compliance checks by entering rules that meet your specific regulatory needs. Provide immediate feedback should the AI fall short of your compliance standards, allowing it to continuously improve over time.

Finspector: Financial Promotions, Simplified.

Get ready to meet Finspector, your financial promotions compliance tool for that automatically reviews content and social media profiles for compliance risks.

Simply upload files and enter social media handles for the AI to inspect, reporting back to you in a matter of minutes. With it's easy and simplified set-up, this is something you could easily use between your compliance and marketing teams.