How to Build Trust and Win New Customers

People want brands they can trust.

Sadly, according to the FCA, less than 50% of UK adults have confidence in financial services.

So how can you ensure that your brand is trusted by potential customers?

Well, the first step is to put yourself in their shoes.

Meet Your Average Joe

Joe is a 35-year-old marketing professional.

He's married with two young children and looking for a life insurance policy to ensure his family’s financial security. He’s seen a promotion for a policy online that perfectly meets his needs!

But as he reads through the offer, he notices words he doesn’t understand, hidden fees, and conditions buried in fine print. He feels a knot in his stomach, unsure whether this promotion is really the right choice for his family’s future.

"Am I being taken for a ride?" Joe wonders.

He wants to trust the brand, but the lack of clarity leaves him feeling confused and uncertain. He doesn’t want to make the wrong decision and put his family’s future at risk.

This emotional uncertainty is common.

And in financial services, uncertainty is heightened because the stakes are so high. Misinformation, lack of transparency, or confusing promotions can have severe consequences. When consumers like Joe feel uncertain about a financial product, they hesitate to engage.

Protecting Joe: FCA and Consumer Duty

Joe’s experience with confusing promotions is exactly why the FCA introduced Consumer Duty, a landmark regulatory framework that came into effect in July 2023.

Consumer Duty isn’t just about following rules—it’s about taking proactive steps to ensure good outcomes for consumers. This principled approach gives the FCA greater enforcement power, allowing them to focus on outcomes rather than just compliance.

So, if a firm is delivering bad promotions—even if it’s technically compliant with specific rules—the FCA can step in and take action.

This shift ensures that firms aren’t just ticking boxes but are genuinely looking out for consumers like Joe, fostering a world that puts their best interests at heart.

Financial Promotions: How Joe Meets Your Brand

Financial promotions are the first point of contact for Joe and your company.

He might see you digitally on a Facebook ad or smiling at him on a billboard.

How he meets you for the first time is very important. We’ve all heard that people make their judgement of you based on the first 7 seconds of meeting, right?

Joe will be judging you just the same.

So making sure that your promotions are as clear as they can be is really valuable to getting new customers on side. Provide emotional reassurance for consumers, by ensuring that the products and services being marketed to them are fair and transparent.

Compliance is Hard!

We know companies like yours are trying their best to keep on top of compliance.

But, let’s face it, staying on top of it all is no easy task. Some common challenges we’ve heard from companies are:

- Too many promotions to handle.

- Marketing and compliance not communicating effectively.

- Records not kept well for FCA purposes.

- Hard to maintain compliance with social media promotions

- Affiliates and influencers posing risks

These challenges make it hard for you to make healthy promotions.

So, how do you deal with this?

Finspector Helps Joe Trust You

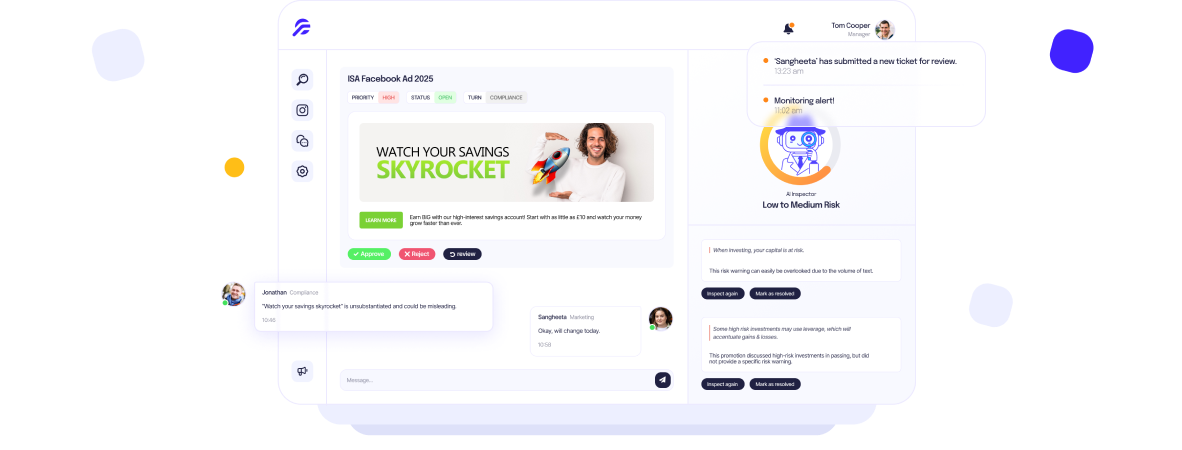

Finspector is an AI-powered tool that ensures financial services brands not only follow FCA guidelines but also create promotions that have Joe’s best interests at heart.

✅ Risk Analysis

Finspector uses AI to inspect promotions in real-time, identifying potential risks such as unclear language or hidden terms that could mislead consumers.

By catching these issues early, you can correct them before the promotion goes live, ensuring that consumers are presented with truthful, transparent information.

✅ Consumer-Centric Suggestions

Beyond ensuring compliance, Finspector helps create promotions that speak directly to your consumer’s needs and emotions.

The AI provides suggestions to improve clarity, remove unnecessary jargon, and ensure that the message is transparent and understandable.

✅ Social Media Monitoring

Automatically inspects affiliate and influencer campaigns to make sure your partners are keeping your customers interests at heart.

Keep Joe’s trust

When consumers trust a brand, they’re not just making a one-time purchase—they’re forming a lasting relationship. Trust leads to loyalty, advocacy, and deeper emotional connections with your brand.

Trust is a key driver of long-term success.

Finspector ensures that your financial promotions are not only compliant but consumer-friendly, helping to foster long-term trust and brand advocacy.

If you’re ready to take your financial promotions to the next level and build a brand consumers trust, Finspector is here to help. Start ensuring your promotions are clear, compliant, and consumer-friendly today.

Find out more. Talk with us today.