Finspector: 4 Features Every Compliance Manager Needs

We know the challenges that managing financial promotions in an evolving landscape can bring. That's why Finspector is designed to help you streamline the approval process, serve consumers better information and avoid potential punishments from the FCA.

Here's the 4 key features Finspector provides to help you achieve those aims.

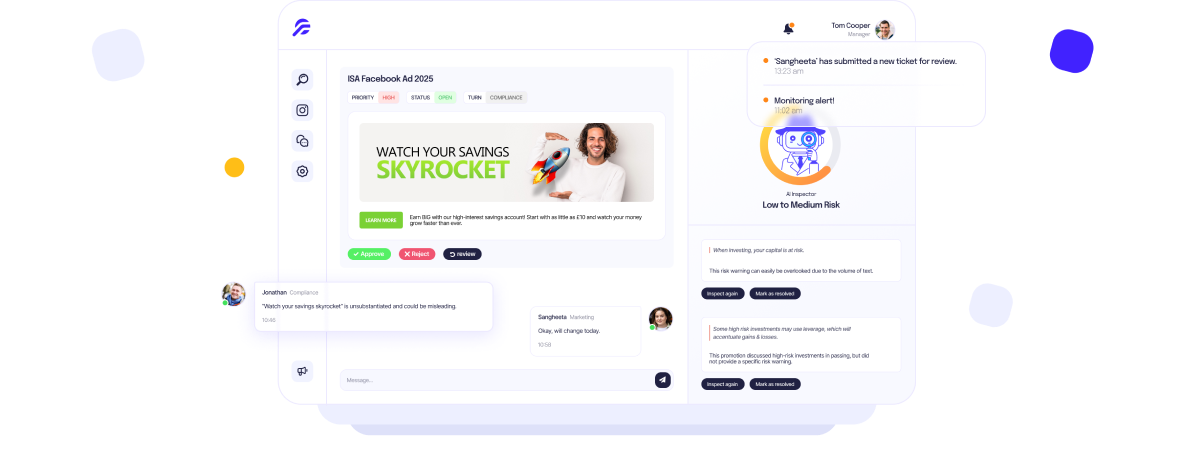

1. Inspect: Pre-Publication Compliance Assurance

In the fast-paced world of financial services, ensuring that every piece of promotional content meets regulatory standards before publication is critical.

The inspect function of Finspector plays a crucial role in this process by inspecting promotional content for potential compliance risks, including those related to risk warnings and prohibitions on misleading claims.

You will receive immediate feedback on content, highlighting risks before they become regulatory problems. This proactive approach not only saves time but also reduces the risk of costly regulatory breaches.

2. Monitor: Real-Time Oversight

The role of social media in financial promotions has grown, but so has the risk associated with their use. It wasn’t long ago that Love Island stars were charged in a crackdown against bad finfluencer promotions.

And that’s something you’ll want to avoid.

Finspector’s monitoring addresses this by inspecting social media history and actively tracking live social media posts, detecting emerging compliance risks as they occur.

That means years of social media posts on TikTok, Instagram or Twitter inspected for potential compliance risks in a matter of minutes. And you will be alerted should a promotion or partner activity fall out of compliance, allowing for swift corrective action.

3. Audit: Comprehensive Logs for Long-Term Compliance

Keeping a log of your systems, processes as well as your financial promotions approvals are all FCA requirements. In other words, you need to have these in place to avoid potential fines and penalties from the FCA.

The audit function of Finspector automates and enhances this process by automatically logging your financial promotions activities.

Additionally, it allows for historical compliance reviews to ensure past promotions remain aligned with current regulations. This feature helps reduce the risk of retrospective action from the FCA.

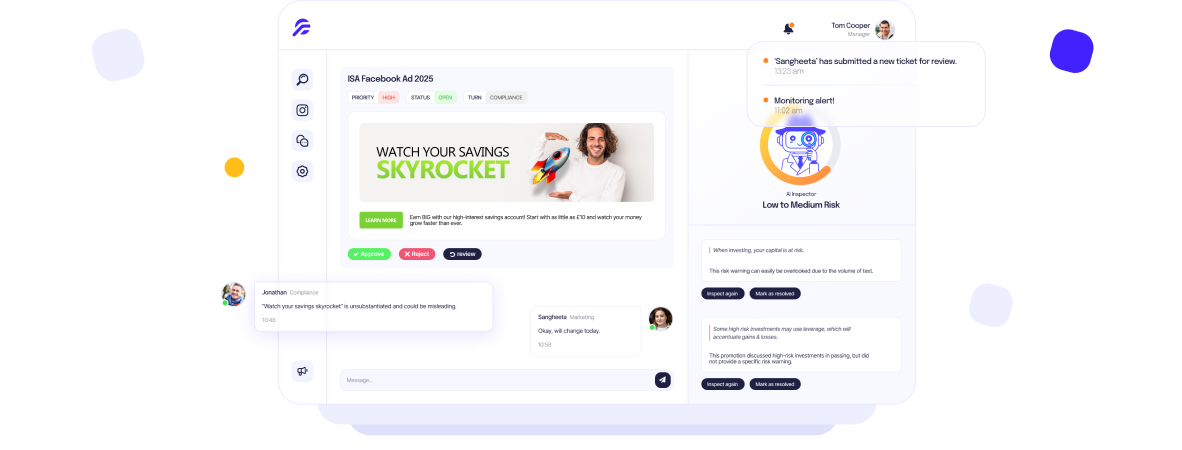

4. Approve: Streamlined Workflow

The Approve function of Finspector provides a clean and efficient dashboard that brings all compliance tasks into one place. This feature allows you to conveniently review and approve promotions while tracking assignments, managing priorities, and leaving comments for your team.

With notifications to alert you of any updates, the approval process becomes seamless and organized.

This streamlined workflow not only saves valuable time but also helps ensure every financial promotion adheres to regulatory requirements, reducing the risk of oversight.

Finspector AI: Smarter Compliance

We know that the evolving regulatory landscape for financial promotions in the UK presents significant challenges. But there’s a wealth of opportunities too, for those willing to leverage advanced technology.

Finspector, with its powerful functions to inspect, monitor, audit and approve can help you not only meet these challenges but also serve your consumers better financial promotions.