FinProm Approval Software: The Secret to Effortless Compliance

Juggling spreadsheets, chasing email chains, and coordinating with marketing or business development teams—sound familiar? For compliance managers, the process of approving financial promotions (FinProms) often feels like an uphill battle.

Whether it’s reviewing investment platform ads or monitoring LinkedIn posts, ensuring every piece meets FCA standards is a time-consuming and frustrating back-and-forth.

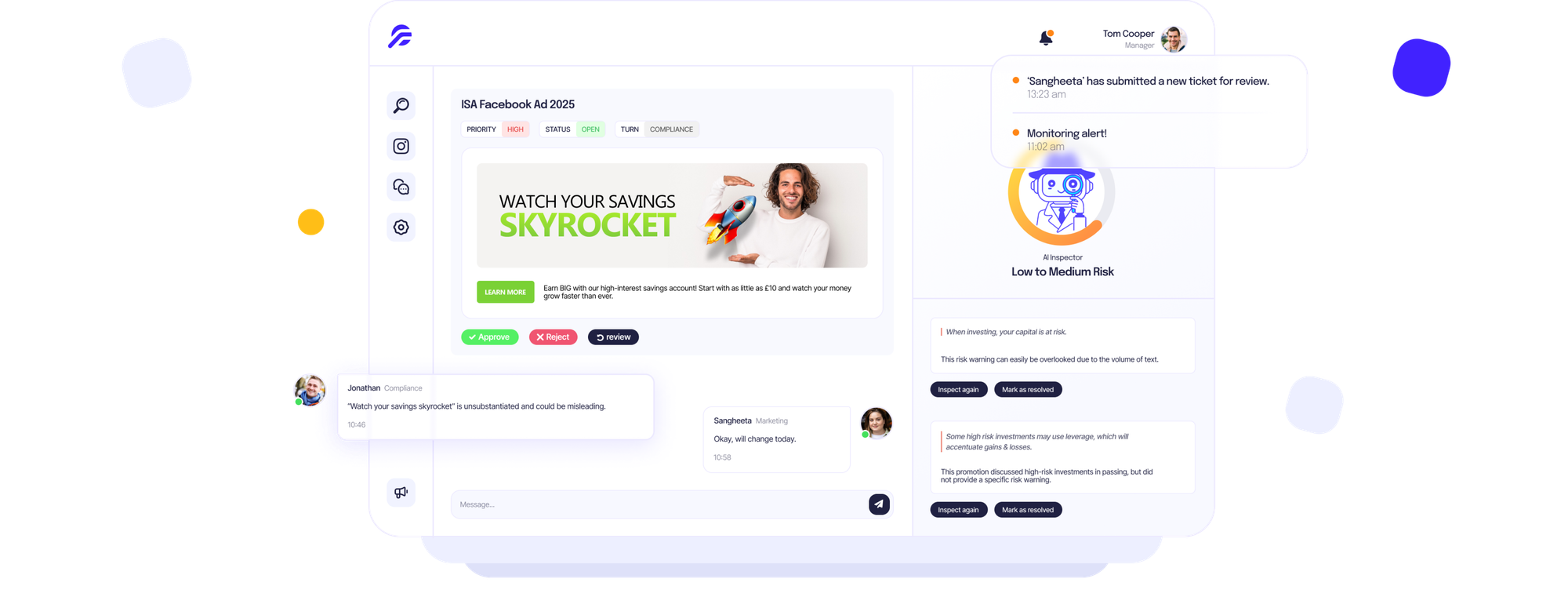

Now imagine if all of this could be simplified. Enter FinProm approval software: your streamlined, all-in-one solution for financial promotions compliance.

Quick Summary of FinProm Approval Software

Simplifies Collaboration: Keeps everything in one place, eliminating messy email threads and spreadsheets.

Saves Time: Automated checks reduce manual effort and speed up approvals.

Mitigates Risks: AI ensures disclaimers are present and identifies non-compliance issues.

Provides Peace of Mind: Audit trails and real-time monitoring keep you compliant and in control.

The Challenges of FinProm Approvals

Endless Back-and-Forth

Compliance managers and marketing teams often face cycles of edits and approvals, with multiple drafts going back and forth. For example, an investment platform drafts an ad campaign. Compliance requests disclaimers, the marketing team edits the draft, and the cycle repeats, creating frustration on both sides.

Lack of Visibility

Managing approvals via spreadsheets and email chains often leads to miscommunication and missed risks. A wealth management firm, for instance, may struggle to track LinkedIn posts from its business development team, creating compliance blind spots.

High Stakes, High Stress

Mistakes in financial promotions can result in significant fines or reputational damage, putting immense pressure on compliance managers to ensure every detail is flawless.

What is FinProm Approval Software?

FinProm approval software is a specialised tool designed to simplify and streamline approvals for financial promotions.

So instead of relying on spreadsheets, messy email chains or workflow tools that need a million workaround you can use a software built for compliance managers. By leveraging automation and AI, it ensures that every piece of content meets regulatory standards before it goes live.

4 Benefits of Using FinProm Approval Software

Communicate Faster

Imagine your marketing team uploads an ad draft for you to review. You check the post, leave comments directly in the system, eliminating back-and-forth emails and keeping everything centralised. The workflow becomes smooth and efficient.

Save Hours on Reviews

AI flags issues, saving you hours of manual review and reducing bottlenecks. You can focus on high-priority tasks instead of chasing edits.

Stay Ahead of Risks

Automatically monitor social media posts, ensuring disclaimers are present and language complies with FCA standards before issues escalate. You’re always one step ahead.

Take Control with Confidence

As a compliance manager, you gain full control of the process with a clear overview of all approvals. No more scrambling through emails or worrying about missed risks. Everything is logged and traceable, protecting your firm and your team.

Real-World Applications

Scenario 1: Investment Platform

Your marketing team drafts an ad campaign promoting a new investment product. You upload the draft to Finspector, which flags a missing disclaimer and an overly optimistic phrase. The issues are resolved within minutes, ensuring the campaign complies with FCA standards and goes live on time.

Scenario 2: Wealth Management Firm

A member of your business development team posts an article about investment opportunities on LinkedIn. Finspector monitors the post in real time, flags non-compliance issues, and sends an alert for immediate correction—before it becomes a problem.

Why Choose Finspector for FinProm Compliance?

Finspector is a FinProm approval software specifically built to address the unique challenges of financial promotions in financial industries like wealth management, cryptocurrency and investment platforms.

Key Features

- Approve Financial Promotions Fast: Automated workflows help your team stay productive and reduce manual errors.

- Spot Risks Early: AI highlights potential compliance issues in text, images, videos, and social media posts.

- Monitor All Channels: Scan influencer content and social media profiles to ensure ongoing compliance.

- Stay Organised: Use a centralised system for comments, notifications, and tasks.

Compliance managers don’t have to feel overwhelmed by the complexities of financial promotions. With Finspector, you can simplify your workflows, reduce stress, and focus on driving results without fear of non-compliance.

Ready to make compliance effortless?

Request a demo today and discover how Finspector can transform the way you manage financial promotions.