Finfluencers to Crypto: Latest Trends in Fintech Financial Promotions

In today’s fast-evolving fintech sector, promoting financial products and services has become more complex than ever. Regulatory scrutiny, shifting consumer behavior, and the rise of digital marketing channels have made financial promotions both a challenge and an opportunity.

As fintech companies innovate and grow, they must also adapt to the ever-changing landscape of financial promotions. So what do fintechs need to know in this evolving space?

1. Increased Regulatory Scrutiny

The explosive growth of fintech has caught the attention of regulators worldwide. With novel offerings like buy-now-pay-later, crypto assets, and new banking solutions, regulators such as the FCA are tightening their oversight to ensure compliance.

But the challenge isn't just about meeting current regulations but also staying updated with frequent regulatory changes. What was compliant 2 years ago may no longer be acceptable, making it essential for fintechs to continually audit and adjust their messaging to avoid penalties.

2. The Rise of Finfluencers and Social Media Risks

Social media has become a key platform for promoting fintech products, but with it comes new risks. The rise of "finfluencers" adds another layer of complexity, as recent crackdowns on misleading financial advice from influencers on platforms like TikTok and Instagram have shown.

Fintech companies are now making sure that their influencer partnerships are fully vetted and monitored to ensure they remain compliant. Quick and casual social media communication can sometimes lead to oversights, making compliance even more critical in this space.

3. Balancing Innovation with Transparency

Fintech thrives on innovation, but promoting more complex products like decentralized finance (DeFi) tools or robo-advisors requires clarity and transparency.

Consumers may not fully understand these services, so promotions must find a balance between being engaging and informative while avoiding misleading claims. Regulatory bodies focus heavily on ensuring fintech promotions are not only clear but also include adequate risk disclosures.

4. Adapting to Multi-Channel Marketing

Fintech companies now need to be present across multiple marketing channels, from social media to email marketing and web ads. Each channel presents its own set of rules, audience behaviours, and compliance challenges.

Ensuring consistency across all platforms while tailoring content to each channel can create bottlenecks in approval processes, requiring seamless coordination between marketing and compliance teams.

5. Consumer Demand for Ethical Promotions

As fintech grows, consumers are becoming more informed and discerning about the products and services they choose. There’s a growing demand for companies to comply with regulations and demonstrate ethical responsibility in their financial promotions.

Recent controversies, like misleading promotions in the crypto space, have highlighted the dangers of prioritizing innovation over consumer protection. Fintechs need to be transparent about risks, avoid misleading claims, and provide educational content that helps consumers make informed decisions.

How Finspector Helps Fintechs Stay Ahead

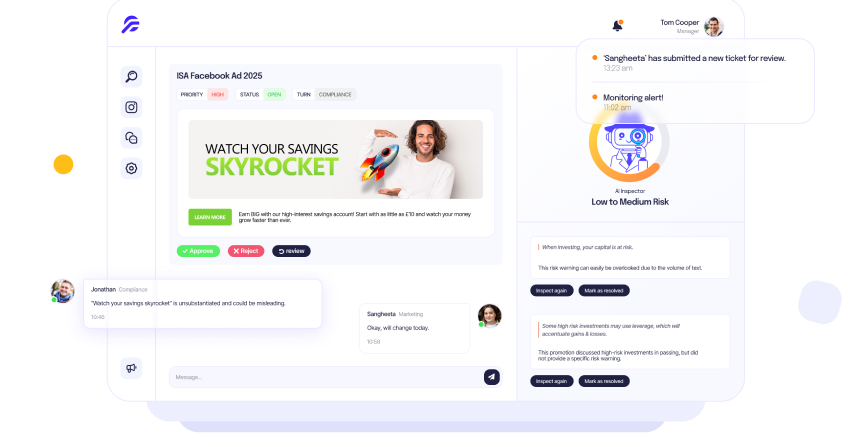

The complexity of financial promotions is increasing, but tools like Finspector are here to help. Finspector automates the inspection, monitoring, approval, and auditing of financial promotions, enabling fintech companies to stay compliant without sacrificing innovation.

With real-time oversight and historical compliance reviews, Finspector’s AI-driven solution helps ensure promotions meet your compliance standards—giving compliance managers greater peace of mind.

- Real-time collaboration for marketing and compliance.

- AI flags potential compliance issues early.

- Scans text, images, video, social media for risks.

- Centralized dashboard for feedback and revisions.

- Comments, notifications, and tasks all in one place.

By streamlining financial promotions, your team can focus on delivering compliant, engaging promotions that resonate with consumers and build trust for the long run.