Finfluencers in Crypto: The Financial Promotions Regime

As the crypto market matures, regulators are stepping in to bring clarity and accountability to the sector. Among these efforts is the Financial Promotions Regime, which sets strict rules on how financial products (including cryptocurrencies) are marketed. We take a look at this regime more closely with Isadora Werneck, Partner and legal expert at Logan & Partners.

This regime demands greater transparency and truthfulness in advertisements and endorsements, addressing the fine line between legitimate advice and manipulation.

How does the Financial Promotions Regime apply to crypto, especially in an industry often defined by decentralisation and rapid innovation?

In addition to the updated guidelines on promotions mentioned above (following legislation passed by Parliament), cryptoassets are now included in the UK's Financial Promotions Regime, meaning they are subject to the same restrictions as regulated investments. This includes requirements for cryptoasset promotions to be fair, clear, not misleading, among others. All firms and individuals marketing cryptoassets to UK consumers, including those based overseas, must comply with these rules. The definition of a financial promotion remains broad and includes communications made through websites or apps, and as a result, nearly all cryptoasset firms providing services to UK consumers are likely to be subject to this regime.

Despite the fast-paced and decentralised nature of the crypto world, which often outpaces regulatory frameworks, the FCA has been ramping up its efforts and enforcement actions. It’s investing tools like web scraping and AI to detect, remove, and take action against misleading or non-compliant financial promotions, particularly on social media. The aim is to protect consumers and ensure that only authorised, legitimate firms and individuals promote financial products. The FCA is also focusing on targeting the highest number of firms unlawfully promoting to UK consumers, including placing companies on its online Warning List and blocking or removing illegal financial promotions across websites, social media, and apps or any online channels that are advertising unauthorised financial products and services.

What are some common mistakes businesses and influencers make when promoting crypto products, and what are the consequences?

Common mistakes include:

- Promoting products without the necessary FCA authorisation or without collaborating with an authorised firm or failing to comply with general FCA promotion rules.

- Not displaying risk warnings before or at the start of promotions, such as risks of volatility, potential capital loss, and regulatory uncertainty.

- Making promotions hard to understand or too complex.

- Not including supporting hyperlinks or separate pathways for consumers to access further information, where applicable.

- Posting content on social media platforms that are not suitable for the type of promotion. For example, firms should consider whether character-limited media or platforms with other restrictions on the information they can communicate are appropriate for promoting complex financial products or services.

- Not restricting or directing promotions for cross-border firms by using separate profiles or geolocation features.

- Failing to assess which products are suitable for promotion by finfluencers.

As for the consequences, the FCA actively supervises and monitors firms' compliance with financial promotion rules, as noted. If a firm is found in breach, the FCA has several enforcement actions available, including issuing takedown requests; placing firms on the FCA Warning List; restricting firms to prevent further harmful promotions; reputational damage and fines; and criminal prosecution brought by the FCA.

"It is important to note that any firms working with influencers can be held responsible for the promotions made by those influencers, so they should keep track of the influencers they work with and not take on more than they can manage."

If they decide to work with influencers, they need to make sure the influencers understand what they are promoting, provide clear guidance on the rules, and actively monitor the promotions to address any issues quickly.

Join us for the final piece in this three-part series with Isadora Werneck, where we’ll discuss what lies ahead for finfluencers and how they can adapt to an increasingly regulated environment.

Compliance Simplified: Finspector

Complying with financial promotions regulations can be complex and time-consuming in the fast-paced crypto industry.

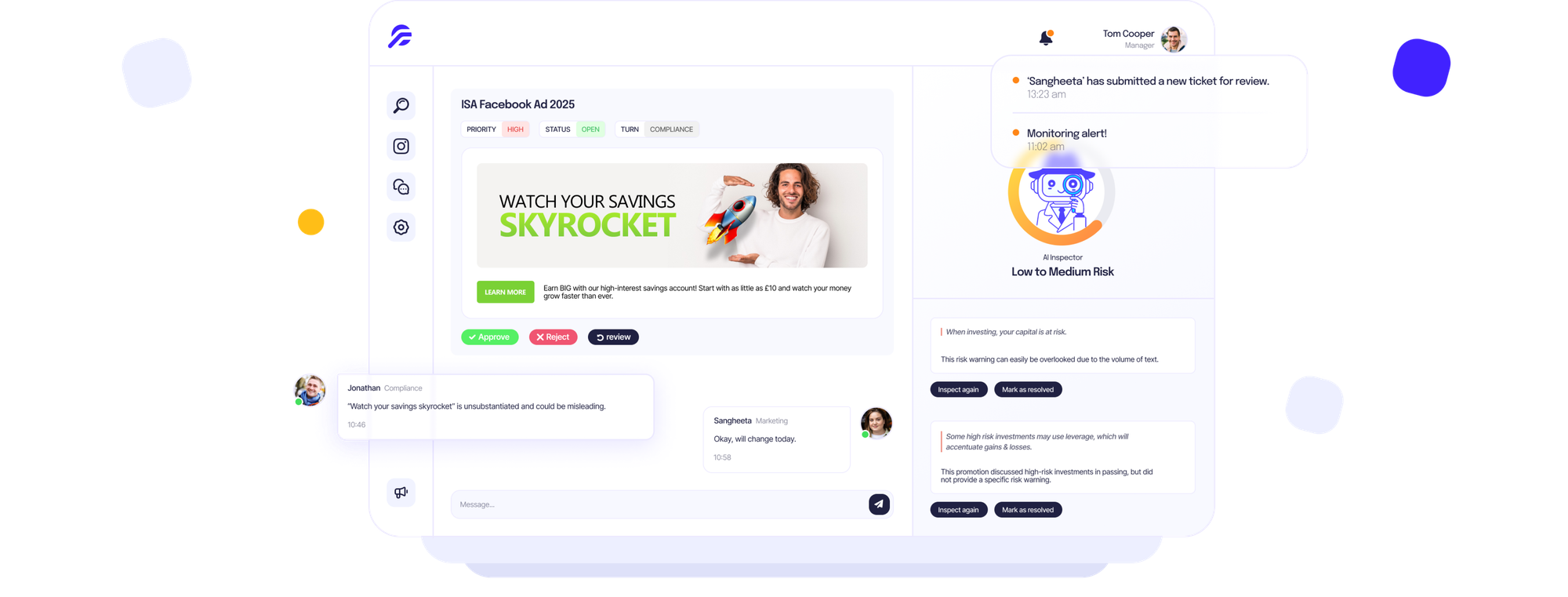

Finspector is an AI-powered solution designed for simplifying financial promotions.

Key Features

- AI Crypto Promotions: Finspector highlights potential compliance risks in text, images, video, and social media posts.

- Monitor Finfluencers: Automatically inspects social media profiles and content to ensure ongoing compliance.

- Stay Organised: Use a centralised system for workflow, comments, notifications, and tasks.

That means crypto firms and finfluencers can ensure promotions meet regulatory standards effectively and build all-important trust with your customers.

Connect with Logan & Partners

For more insights and tailored legal guidance in the crypto space, reach out to Logan & Partners. Their expertise in financial compliance ensures businesses and influencers stay ahead in an increasingly regulated landscape.