Finfluencers in Crypto: Understanding the Risks

Financial influencers, or ‘finfluencers’, have become pivotal in shaping the market, guiding investor behaviour, driving trends, and even fuelling the rise or fall of projects. However, their growing power comes with significant risks, not just for consumers but also for the firms unwittingly tied to their activities.

To explore these dynamics, we spoke with Isadora Werneck, Partner and legal expert at Logan & Partners, for her insights into crypto finfluencers and the impact of the Financial Promotions Regime in this ever-evolving market.

Finfluencers: Power and Pitfalls

Crypto finfluencers often serve as the public face of crypto for millions of followers. Only a couple of weeks ago, reports surfaced about rising influencer Logan Paul being accused of misleading fans with questionable crypto investments. As history shows, a single influencer’s endorsement can trigger price surges, massive sell-offs, or even mainstream adoption of obscure tokens.

But with this level of influence comes immense responsibility, and consequences. We asked Isadora about the dangers tied to finfluencers’ unchecked authority:

Finfluencers have become a key source of financial advice for many investors. From your perspective, what’s the biggest problem with their growing presence in crypto?

For financial service companies, working with trusted influencers to promote their products on social media can be a good business strategy. However, it’s important to ensure the influencer is legally allowed to do so. This is because depending on what is being promoted or offered, a finfluencer might;

(a) be giving financial advice on regulated products and/or

(b) promoting the product itself.

Providing such advice is a regulated activity which requires permission under the Financial Services and Markets Act (FSMA). Financial promotions are also strictly regulated, and can only be made either by someone authorised under the FSMA, approved by an FCA-authorised person, or under a very limited number of exceptions.

One of the main issues arises when unregistered influencers promote financial products or give financial advice without the proper authorisation, or even if they are registered, fail to follow all FCA guidelines. Besides the potential harm to consumers, those who illegally share financial promotions with UK consumers could be committing a criminal offence, facing penalties like up to two years in prison or unlimited fines.

The FCA can also demand offenders return any money received and, in some cases, offer additional compensation. Because of this, businesses need to carefully consider whether a finfluencer is the right person to promote their financial products, and influencers should work responsibly with these businesses.

"While many finfluencers act in good faith, some may inadvertently promote misleading financial activities or scams, which can attract FCA scrutiny."

In your experience, have legal frameworks caught up with the ways finfluencers operate? Are there any high-profile cases where they’ve faced penalties or lawsuits?

In the UK, the FCA has recently stepped up its efforts to address the risks associated with finfluencers. For example, the FCA has brought criminal charges against reality TV stars and social media influencers who promoted an unauthorised foreign exchange trading scheme involving high-risk contracts for difference (CFDs). The charges include making unauthorised financial promotions and violating rules around conducting unauthorised activities. Convictions for these offences could lead to fines and/or up to two years in prison. In October of this year, the FCA issued 38 alerts about social media accounts run by finfluencers that may be promoting illegal financial products.

Earlier this year, the FCA also updated its guidelines on promoting financial products via social media. The new guidance clarifies that both direct and indirect promotions (e.g., retweets, story shares, and direct messages) are subject to the financial promotion rules, and that each promotion must meet the compliance requirements on its own. The FCA also warns that social media may not be the best platform for promoting complex products like cryptoassets, and that firms must consider whether platforms with limited character or space are appropriate for such promotions.

In the second of this three part series with Isadora, we’ll explore the Financial Promotions Regime and what it means for those promoting crypto products.

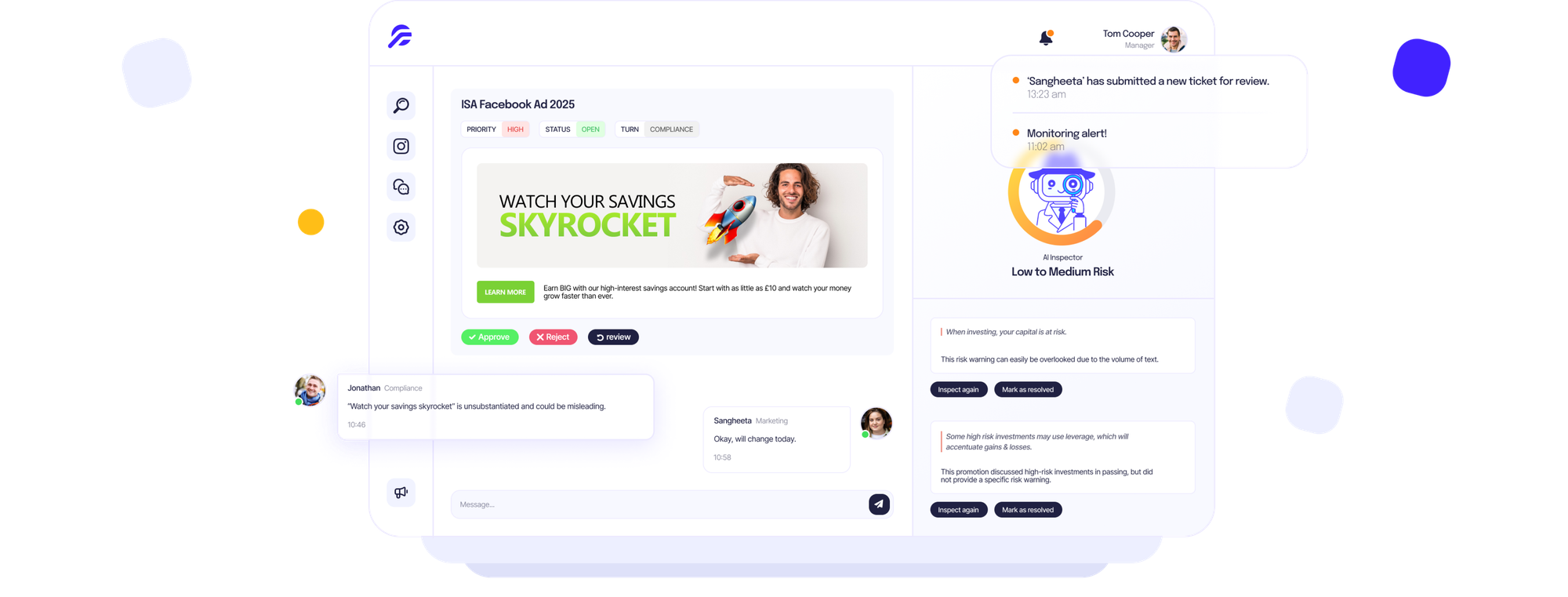

Compliance Simplified: Finspector

Complying with financial promotions regulations can be complex and time-consuming in the fast-paced crypto industry.

Finspector is an AI-powered solution designed for simplifying financial promotions.

Key Features

- AI Crypto Promotions: Finspector highlights potential compliance risks in text, images, video, and social media posts.

- Monitor Finfluencers: Automatically inspects social media profiles and content to ensure ongoing compliance.

- Stay Organised: Use a centralised system for workflow, comments, notifications, and tasks.

That means crypto firms and finfluencers can ensure promotions meet regulatory standards effectively and build all-important trust with your customers.

Connect with Logan & Partners

For more insights and tailored legal guidance in the crypto space, reach out to Logan & Partners. Their expertise in financial compliance ensures businesses and influencers stay ahead in an increasingly regulated landscape.