6 Weeks Too Late: Why Facebook Is a Compliance Risk

“Meta, in particular, has had slower turnaround on takedown requests, sometimes taking up to six weeks.” — Lucy Castledine, FCA

Financial content doesn’t just reach followers—it finds them.

Whether shared by influencers or surfaced by algorithms, financial promotions spread fast. But as highlighted by the FCA in a Treasury Committee session on 30th April, enforcement doesn’t move nearly as quickly.

The bottom line is you cannot wait for social platforms to remove non-compliant promotions. You have to be proactive.

What Are the FCA’s Concerns About Facebook?

The FCA has raised concerns about finfluencers promoting high-risk or illegal investments on social media. In a 2025 Treasury Committee hearing, they revealed that:

- Takedowns on platforms like Meta can take up to 6 weeks, leaving harmful content online for too long.

- Algorithms amplify risk by surfacing content to users based on engagement—not just who they follow.

- FCA enforcement is increasing, with 38 consumer alerts and 20 interviews under caution issued in the past year.

- Regulated firms must take proactive responsibility, rather than relying on social platforms to manage compliance.

The Viral Risk Window

The problem isn’t just that non-compliant content exists. It’s that it travels fast.

Content that blurs the line between financial advice and promotion can reach tens of thousands of users before the first takedown notice is even seen. One like, one comment, one saved video—and the algorithm does the rest, surfacing risky content to entirely new audiences.

As FCA Director Steve Smart explained, “You don’t need to follow the finfluencer, you just need to engage with similar content, and the algorithm does the rest.” (Treasury Committee, April 2025)

This viral risk window is where real harm happens—when scams, misleading claims, or unauthorised promotions get the head start.

Facebook isn't Built for Financial Compliance

Social platforms like Instagram, TikTok, and Facebook are built for engagement, not enforcement. Their moderation systems aim to remove offensive or harmful content—but they’re not optimised to identify regulatory breaches around financial promotions.

As the FCA noted, some takedown requests are left pending for over a month. And while some platforms (like YouTube and TikTok) are showing improved responsiveness, others, notably Meta, have been significantly slower.

That’s six weeks of exposure. Six weeks of reputational risk. Six weeks of regulatory vulnerability.

The Burden is on You

The FCA is increasing pressure on firms to take proactive responsibility. Between April 2024 and April 2025, the regulator issued 38 consumer alerts and conducted 20 interviews under caution, often involving individuals or firms promoting high-risk or unauthorised investments (FCA testimony, UK Parliament, April 2025).

And these numbers only reflect the cases pursued. Many more fly under the radar.

The message is clear: firms must not wait for platforms to protect them—they need their own systems in place. Because once content is public, the damage may already be done.

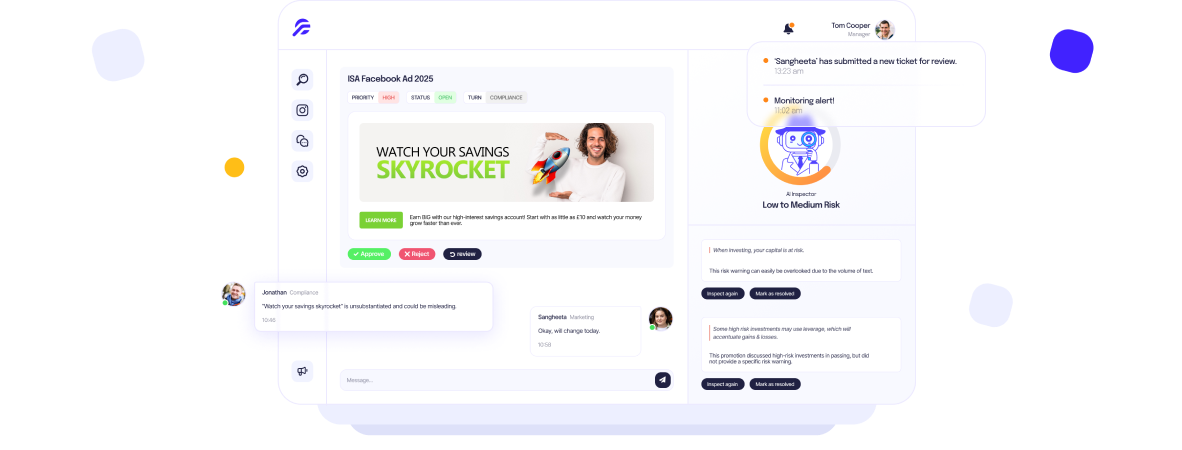

How Finspector Helps You Stay Ahead

In this environment, proactive compliance isn’t optional—it’s foundational.

Finspector was designed for this exact moment: when financial promotions are fast, decentralised, and high-stakes.

Here’s how we help regulated firms and marketing teams get ahead of the risk curve:

- Inspect: Use AI-powered, pre-publication checks to review text, video, imagery, and disclaimers before content goes live. Catch potential issues while there’s still time to act.

- Monitor: Keep tabs on external content—including influencer partnerships, affiliate campaigns, or third-party mentions—so nothing slips through the cracks post-publication.

- Audit: Automatically log every promotion, decision, and review for a full compliance trail. Perfect for internal reporting or responding to FCA enquiries.

- Approve: Collaborate seamlessly across marketing, compliance, and legal teams with a shared dashboard, ensuring speed doesn't come at the cost of safety.

With these tools, Finspector gives firms the infrastructure to act before the FCA does—and well before any content needs to be flagged by an overstretched social media team.

Final Thoughts: The Clock Is Ticking

The old mindset of “we’ll deal with it if someone flags it” no longer works. Content spreads too fast. Enforcement is tightening. And the platforms you rely on may not respond in time.

Regulators have made it clear: the responsibility is yours.

Finspector helps you own it—before risk becomes reality.