4 Ways to Reduce Financial Promotions Risk with AI

In the highly regulated world of financial services, managing risks in financial promotions is critical. As compliance and marketing managers know all too well, misrepresentations, missing disclaimers, and inaccurate risk warnings could lead to severe compliance breaches and some hefty financial penalties.

With traditional risk management methods already time-consuming and prone to human error, the explosion of financial promotion in social media and digital marketing, means the complicated life of the compliance manager just got that much more challenging.

Which is why more and more compliance managers are turning to AI-based solutions to help them decrease risk effectively and efficiently. Let's take a closer look at why compliance teams are making the move.

The Importance of Accurate Compliance Reviews

We know that getting compliance right is key since slip-ups in compliance can lead to major breaches and some pretty substantial fines.

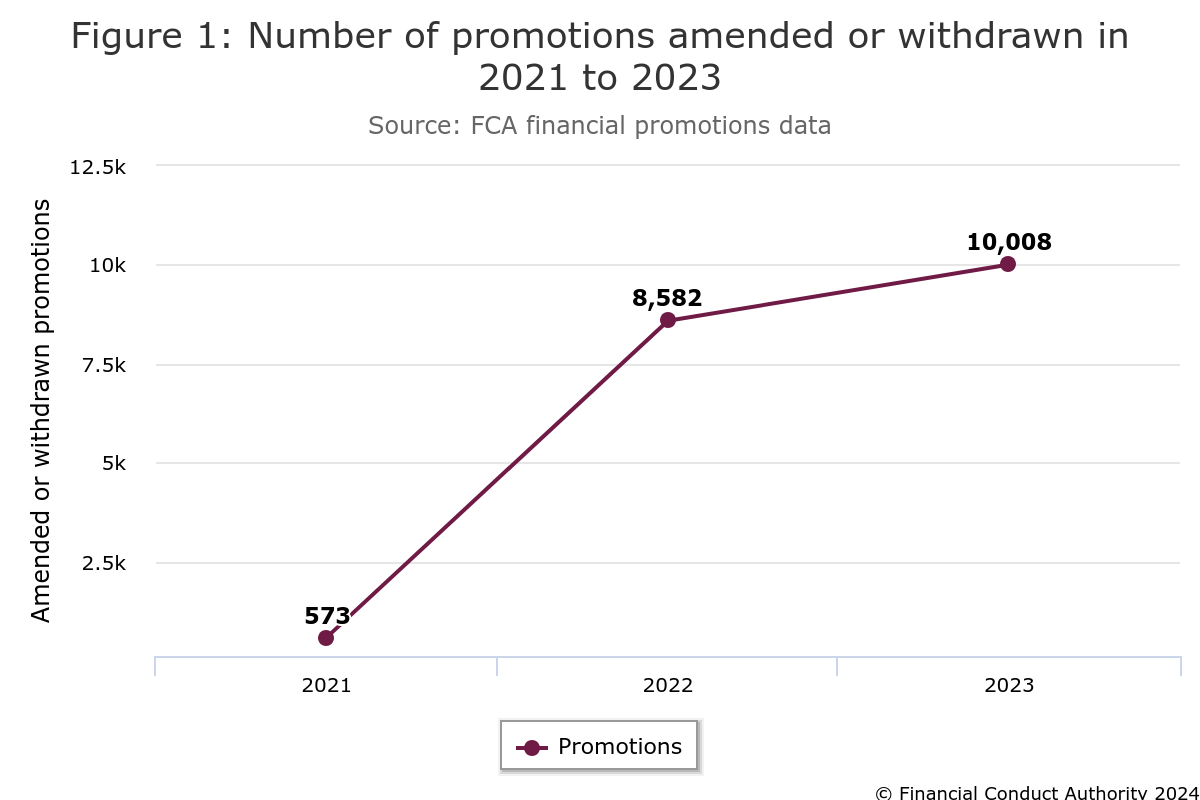

Back in 2023, the FCA intervened to amend or withdraw over 10,008 promotions from authorised firms, a 16.6% increase from the previous year and an even bigger jump from the year.

For the average compliance manager, this growing scrutiny means they need to be even more meticulous with their compliance checks to avoid being made an example of. Here are just some of the firms who recently found themselves on the wrong side of the FCA's guidelines:

- London Capital & Finance (LCF): The FCA fined a former director of LCF, £31,800 for signing off misleading financial promotions leading to significant losses for thousands of retail investors (FCA)

- Leslie and Bennett: The FCA imposed fines of £28,000 each for assisting in the promotion of unregulated collective investment schemes resulting in over 800 people investing around £30 million (FCA)

- Crypto Promotions: The FCA issued 450 consumer alerts related to illegal crypto asset promotions between October and December 2023 (FCA)

With that said, it's safe to say that getting it wrong is simply not an option for compliance managers today. Yet with their workload only set to grow it's become business-critical to find a solution that helps them manage this burgeoning volume at speed.

4 Ways AI Enhances Accuracy and Reduces Risk

With the ability to take the daily drudgery of compliance checks into warp speed, AI-based tools allow compliance managers to unburden themselves of the volume of checks so they can focus on the quality of their work as opposed to the quantity. Here are some more of the advantages compliance managers are seeing when using AI-based tools.

- Consistent Standards

The first and most obvious benefit is that AI tools reduce the risk of human error by consistently applying regulatory standards to all content. For instance, an AI tool can automatically scan, identify and flag missing disclaimers, inappropriate claims about product benefits, and incorrect risk warnings.

- Real-Time Feedback and Adaptability

AI systems can take on feedback, allowing them to improve and adapt to your custom compliance standards. This feature is crucial for maintaining up-to-date compliance standards and improving the accuracy of reviews over time. For example, an AI system that receives feedback on a new regulatory change can quickly integrate this information and apply it consistently across all future reviews.

3. Proactive Risk Management

AI technology allows compliance teams to proactively manage risks by continuously monitoring promotional content and flagging potential issues before they become breaches. This proactive approach helps in identifying and rectifying compliance issues in real-time, significantly reducing the risk of non-compliance.

4. Comprehensive Auditing and Monitoring

And finally, AI systems maintain detailed records of reviews and decisions, providing a clear audit trail for regulatory inspections. This transparency helps demonstrate compliance efforts and mitigates the risk of regulatory penalties. Automated audit logs track every change made during the review process, making sure that all actions are documented and easily accessible during an audit, which means compliance managers can rest a little easier knowing they have not only set-up a cleaner process but that their is also an equally automated audit trail.